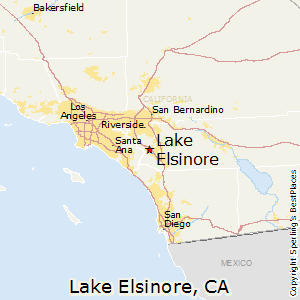

That it user-amicable map enables you to quickly determine if your need area qualifies to have a beneficial USDA Loan, beginning doors in order to sensible resource options and you may a gratifying lifetime into the your perfect community.

Utilizing the brand new DSLD Mortgage USDA Resource Eligibility Map

Using our very own map is simple! Just enter in the fresh address of the house you’ve discover, and also the chart have a tendency to quickly direct you if it drops within a great USDA-qualified town. Portion showcased when you look at the reddish try ineligible, if you are parts instead of purple shading are eligible to own USDA Fund. Its that easy to get started in your path to homeownership.

What exactly is a great USDA Mortgage?

Good USDA Loan, backed by the us Agency regarding Farming, was a government-covered mortgage tailored particularly for lowest- in order to moderate-income homeowners during the eligible rural parts. USDA Fund provide numerous positives which make homeownership a great deal more accessible, including:

- No downpayment needs : USDA Funds generally speaking don’t need a down-payment, reducing the latest monetary load of shopping for a home.

- Low interest rates : USDA Finance usually have aggressive interest levels, while making monthly premiums inexpensive.

- Flexible borrowing requirements : USDA Fund become more lenient which have fico scores compared to the Traditional Money, beginning doors to help you a broader set of consumers.

- Shorter financial insurance policies: USDA Funds possess straight down home loan insurance fees than other financing brands.

If you would like do so much more browse prior to taking another step towards American Dream, check out the publication, What is A good USDA Loan?

The USDA Eligible Possessions Chart Performs

So you’re able to qualify for a USDA Mortgage, the house or property you find attractive must be located in a beneficial USDA-designated qualified area, since the shown into the all of our chart.

While USDA Funds are usually with the outlying areas, the brand new eligible portion try larger than you might think! Of numerous brief metropolitan areas and you will residential district teams slip inside the USDA’s definition out-of outlying. Use our very own entertaining USDA Qualifications Chart and see a wide range off locations where might be ideal for your upcoming family.

- No. 1 home : The home can be used since your top home, maybe not a vacation domestic or investment property.

- Small proportions : Considering USDA recommendations, a house is regarded as modest sizes when it is significantly less than 2,000 square feet. Although not, you can find exceptions, so it’s worthy of calling a loan Manager which have experience in USDA Money.

USDA Mortgage Eligibility Conditions

Beyond the property’s location and you may status, additionally need certainly to fulfill particular debtor eligibility standards so you’re able to qualify for a great USDA Loan. These types of conditions were:

- Earnings restrictions : Your revenue must fall from inside the USDA’s earnings constraints to suit your city.

- Creditworthiness : If you are there’s no minimum credit rating specifications , good credit rating is also improve your probability of recognition and you will safer most useful loan terminology.

- Debt-to-money proportion : Your debt-to-income ratio would be to have demostrated your ability to settle the mortgage.

If you’ve attempted new USDA eligibility assets map however they are however being unsure of for people who fulfill the qualifications standards, contact DSLD Mortgage’s experienced Loan Officials . They are able to chat you through the use of the latest USDA Eligibility Chart and upcoming give you customized pointers predicated on your financial situation and homebuying desires.

Speak about Their USDA Mortgage Choices which have DSLD Financial

DSLD Home loan can be your top spouse inside the dealing with new USDA Mortgage procedure. The knowledgeable Loan Officials focus on working out for you find the better money services for your needs.

Regardless if you are playing with all of our USDA Mortgage urban area chart to understand USDA Loan-eligible portion or researching the new USDA lending chart reputation, we have been right here to guide you.

We shall make it easier to know if an excellent USDA Loan is great getting both you and show you loan in Choccolocco Alabama from the procedure of protecting good USDA Financial to suit your fantasy family. Our team may also help you are sure that the fresh subtleties of the fresh form of the latest USDA Qualifications Map, guaranteeing you have the very up-to-go out pointers.

The USDA Qualifications Venue: Initiate Your Journey Today!

If you think you’ve receive an aspiration domestic that meets this new USDA Mortgage Qualifications Map requirements or was thinking about an excellent higher venue for the USDA Mortgage certification chart that sparks your focus, please extend. We can make it easier to see the USDA Eligibility Chart in detail and you can guide you towards searching for your ideal USDA-eligible assets.

Willing to explore the likelihood of a separate style of way of living? Do the first step on the fantasy domestic by the asking for a beneficial 100 % free visit having a DSLD Loan Administrator . We are going to make it easier to influence your eligibility, respond to questions you have got, and you may make suggestions from the pre-qualification processes. Usually do not miss out on the ability to help make your homeownership goals possible!