Some types of get to let mortgage loans are not regulated by new FCA. Think carefully prior to securing almost every other expenses against your home. Since home financing is actually safeguarded facing your residence, it could be repossessed if you do not keep up with payments on your home loan. Security create from your home can also be protected facing it.

Bankruptcy proceeding is not a financial dying sentence. In fact, there are a few things to do shortly after claiming bankruptcy proceeding to greatly help reset your financial standing and just have a mortgage from inside the the future.

Because there is zero hold off requirement to apply for home financing once bankruptcy proceeding, it is vital to allow your borrowing time and energy to restore into the acquisition to make sure recognition.

After you have re-established their borrowing, you can get a mortgage. What type of home loan you could get, and you may whether or not you meet the requirements, is determined by a few products, including: how much time back you announced personal bankruptcy, how big their downpayment, your full debt-to-provider ratio (how much cash loans you take towards than the their full income) plus financing-to-well worth ratio (mortgage worth rather than the property worthy of).

This is a classic financial, that normally offer the welfare costs. To try to get these types of mortgage once bankruptcy the next conditions use:

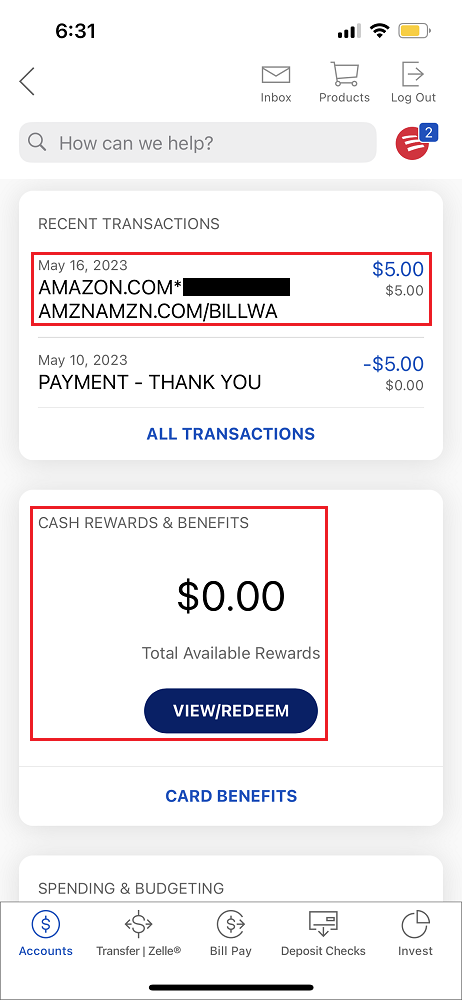

When you find yourself in a position to demonstrate that you are in charge having so it credit card if you are paying your debts in full every month rather than overspending, this will help to alter your credit score

- The bankruptcy proceeding is a couple of years, twenty four hours earlier in the day

- You have got you to-year off lso are-established borrowing from the bank for the one or two credit activities (mastercard, car lease, loan).

- You have got the absolute minimum downpayment of five% on the earliest $five-hundred,000 and ten% for all the extra count more than one to

- You have financial insurance coverage needed for the off repayments significantly less than 20%

If you find yourself in a position to demonstrate that youre in control which have this bank card if you are paying what you owe in full monthly and never overspending, this will help to adjust your credit score

- You really have a total loans-to-solution ratio of 44% limitation

- Your loan-to-worthy of proportion is 95% minimum

These types of home loan falls anywhere between a traditional and private mortgage, definition you be eligible for over personal however sufficient to own a classic loan. To try to get these financial:

If you are able to reveal that you are responsible with it bank card by paying your balance in full each month and never overspending, this helps to change your credit score

- Your own bankruptcy are 3 one year early in the day

- You really have an entire personal debt-to-solution ratio off fifty% limitation

- Your loan-to-worthy of ratio is actually 85% minimum

Or even qualify for a vintage or subprime mortgage, there is the option of looking into a private home loan. Typically, your own interest rate could well be high on an exclusive mortgage however, there isn’t any wishing months immediately after bankruptcy additionally the criteria are the following:

If https://paydayloanalabama.com/spring-garden/ you have prior to now declared personal bankruptcy and are also now seeking start more and implement having a home loan, don’t hesitate to get in touch with myself getting qualified advice and you may to examine your options today!

Find out about bringing home financing immediately following bankruptcy within book. We define just what bankruptcy proceeding are, the way it may affect your credit score, mortgage app plus.

Need to know Far more?

Fill in this type and we will contact your so you’re able to guide a free of charge training that have one of our mortgage advisors.

Declaring bankruptcy proceeding are a lifetime-switching knowledge, however it need not be the termination of their homeownership dreams. Whilst it tends to be more challenging to obtain a home loan once bankruptcy proceeding, it’s not impossible. We discuss everything you need to realize about getting home financing after bankruptcy proceeding inside publication, out-of the length of time you’re going to have to hold off so you can the way to alter your possibility of approval.