When customers are searching for a special domestic, will among the first issues to inquire about is how far regarding a home loan do we afford? By using a mortgage calculator to possess Phoenix, Arizona consumers may an idea of mortgage will cost you. Buyers must always start out with a bank knowing exactly how most of a home loan they be eligible for. A consumer’s credit history and you may money try a key foundation. However, your debt so you can money ratio together with products on count consumers qualify for.

Customers bringing that loan are extremely to get a payment per month. Sure, our house may cost $300,000. Yet not, a buyer desires to understand how much new monthly home loan commonly cost.

This is how a mortgage calculator will help. That with a home loan calculator, a buyer is also determine if he’s more comfortable with the brand new payment immediately following delivering to the other month-to-month costs and savings. Consumers should also understand how they invest the discretionary earnings.

Create that they like commit out to eat? Create they would like to take a trip? Along with, buyers need to look at their lifestyle and also make behavior Pleasant Valley loans to the how they must purchase their funds.

?? What’s Typically Used in Mortgage repayments?

- Interest

- Loan amount called Principle

- Taxes loan providers usually collect a fraction of your annual fees each month, upcoming they is actually due they will certainly outlay cash on your behalf

- Resident Insurance also known as Hazzard insurance policies. This handles your house out of flame, cinch, theft or any other damage

Bear in mind, for individuals who put less than 20% down on your purchase, try to and additionally pay Private Financial Insurance coverage (PMI).

No, new HOA fee is actually charged individually towards the resident that’s perhaps not a portion of the mortgagee commission. The bank will take under consideration the amount of the HOA does inside the calculating the debt so you can income ratio. All of the HOAs statement according to their unique plan. And, certain usually bill month-to-month, specific every quarter, specific partial-a year or per year. Be aware that particular organizations ple out of multiple HOAs could well be groups inside the a great gated area, inside a master-arranged people. The expense of a great HOA is another month-to-month costs having homeowners.

? What is Personal Home loan Insurance rates ( PMI)?

Individual Financial Insurance policies (PMI) are an amount so you can a purchaser when less than 20% out-of a downpayment is done (Virtual assistant fund is an exception). That isn’t to protect your. This is certainly to guard the financial institution should you standard on the mortgage. Usually, customers placing off below 20% towards the property buy will face foreclosures than simply a purchaser which have at the least 20% or even more.

As to the reasons? Since the a buyer getting really of one’s own money with the get features quicker spent and possibly may go off the home.

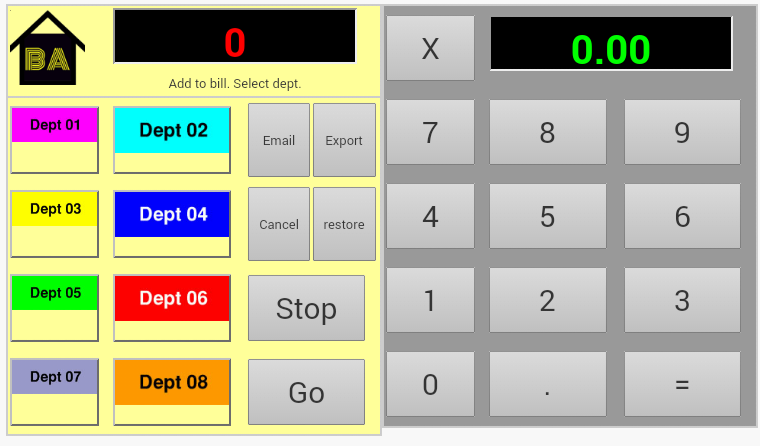

The borrowed funds Calculator having Phoenix, Arizona will allow the consumer to put in a cost out-of a property. Also, they are able to next imagine the speed. In the event the a purchaser was getting down lower than 20% for a down payment, the mortgage calculator commonly determine 20% towards expected private mortgage insurance (PMI).

However, the new exception to this rule was a beneficial Va buyer, who’s not required to pay PMI. Also, property taxes have to be taken into consideration, since lender often collect towards property fees on month-to-month mortgage. Simultaneously, The financial institution will additionally assemble having citizen insurance rates.

? Exactly what Home loan Calculator Must i Include in Maricopa State?

You need a home loan calculator your county. Key factors always assess a mortgage are definitely the purchase price, interest rate, downpayment, and you can duration of a loan. This might be probably going to be a comparable in all counties within the Arizona.