- Credit history : Your credit score is an essential determinant of capacity to pay a loan. Casing finance try enough time-term fund. Your ability to settle are a significant cause of brand new approval otherwise rejection away from a home loan. A dismal credit rating increases the chances of your property financing software rejection. Your capability to settle is a critical cause for the approval otherwise rejection regarding home financing. Before you apply, feedback your credit score and you may rating.

- Loan amount : Specific consumers apply for an amount borrowed that is method past the qualifications. Repaying costs is also alter your get and you will enhance financing qualification.

- Other Constant Finance : Your loan application also can score denied if you’re currently repaying specific lingering loans. To acquire financing acceptance, you should not getting expenses more than 50% of the month-to-month money to the financing repayments. Having many money will have a detrimental effect on your very own profit and just have the payment skill. Thus, you need to obvious one lingering fund before applying to own a homes financing.

Financial Harmony Import

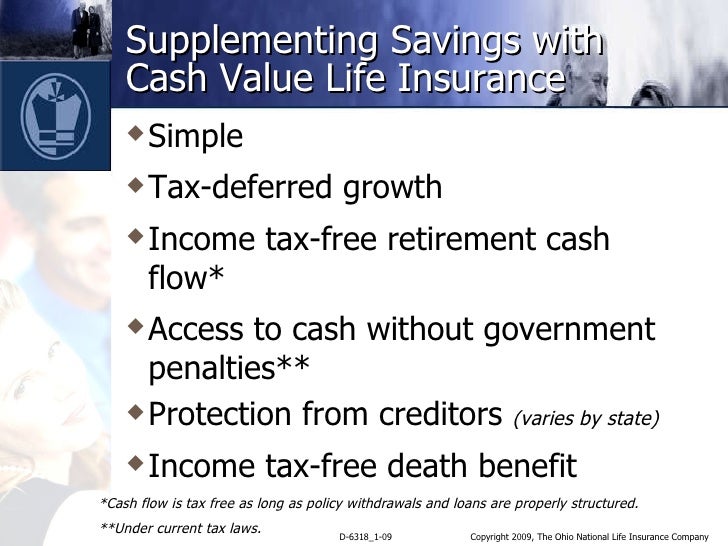

Paying down expense normally alter your rating and you will promote mortgage qualification. Banks dictate the maximum amount borrowed centered on your current month-to-month income. If financing is denied because it is higher than their qualifying number, imagine reapplying once decreasing the asked count. Because the rates of interest drop, refinancing can result in lower EMIs and generous focus discounts.

Advantages of Financial Harmony Import

- Hassle-100 % free processing : Mobile a home loan try stress-totally free. The new eligibility criteria of your processes are pretty straight forward and need limited documents.

- Personalised repayment choices : Applicants will enjoy customized fees options to keep the houses financing reasonable. Which have a lesser interest rate, borrowers can either desire see down EMIs otherwise a smaller tenure.

- Affordable rates : When you are purchasing over-field rates, mobile your residence financing was economically of use. Apply our home Loan harmony transfer choice to re-finance their financial in the faster rates, resulting in down monthly installments and improved deals.

- Change the financial period : When you import home financing, you might choose to reconstitute loan terms and conditions and change the home financing period or perhaps the cost several months according to debt capabilities.

- Top-upwards loan : A mortgage balance transfer has got the advantage of good significant most readily useful-upwards mortgage that provides a relatively straight down interest than the unsecured loans.

Ideas on how to Change your Likelihood of Providing a home loan?

1. Credit clean-right up : Your credit score is a vital factor of consideration. A high credit rating makes it much simpler for you to get that loan. When you have a decreased credit rating, identify the causes by the checking your credit history. Sometimes, lesser problems apply to your credit rating negatively. In this situation, modify Borrowing from the bank Suggestions Agency (India) Restricted (CIBIL) instantly regarding the mistake.

dos. Determine your debt-to-earnings ratio : Lenders analyse your current income to choose your ability to pay your house financing EMIs. If possible, you can test to boost your own yearly money by way of a member-big date business otherwise from the selling quick assets such holds. Since your financial obligation-to-income ratio grows, your odds of providing financing may also increase.

step 3. Curb your borrowing : For people who borrow extra cash than simply you should satisfy their financial aim, your chances of delivering a houses financing is actually shorter. Save your self and purchase much more, and take wise phone calls exactly how much currency you might need as a loan and you will make an application for that one matter.

cuatro. Incorporate an excellent co-signor otherwise guarantor : Often times, it can be difficult to find that loan oneself agreement. Consider incorporating a beneficial co-signor otherwise guarantor with a good credit score. An effective co-signor or guarantor implies that you only pay your residence financing EMIs on time, of course, if you fail to do it, he could be prone to repay the mortgage for you. Yet not, payday loan Mcarthur providing a great co-signor otherwise guarantor comes with its conditions and terms and so be sure to pay attention to the exact same.

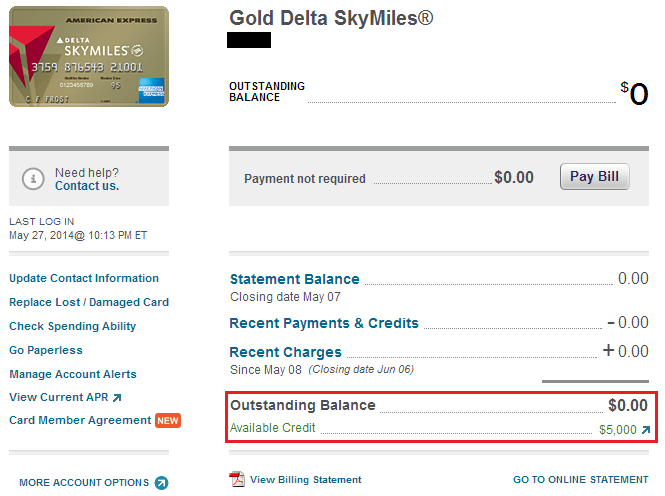

Evaluate just how much you can afford into the month-to-month EMIs, provided all your valuable expenditures, in addition to people established money and you may bank card expenses. Fundamentally, finance companies make it EMIs so you’re able to create doing 40% of net month-to-month earnings.