Property conditions

Along with the borrower’s certificates, the property have to meet with the FHA’s lowest property criteria to finance an effective foreclosed home with an enthusiastic FHA loan.

- Appraisal called for. Before granting the loan, the HUD tend to designate a keen FHA-accepted appraiser to review the house or property. Not only can brand new appraiser measure the home’s worth, however, they’ll together with suggest any extreme ruin that might be something.

- Compatible updates. Should your appraiser finds out conditions inside your home which could twist a threat toward safety of the occupant otherwise threaten brand new soundness and you may design ethics of the house, more checks or solutions tends to be needed.

Financing restrictions

If you have found any kind of requirement mentioned above, then https://paydayloansconnecticut.com/pemberwick/ there’s only 1 step leftover: how big your loan. On a yearly basis, the newest HUD releases the newest FHA mortgage floor and you will ceiling financing constraints.

- Flooring limit. This is basically the minimum loan amount you could potentially get. As of this year (2022), minimal mortgage you might submit an application for was $420,680 to possess a single-product possessions.

- Threshold restriction. Since you may features guessed, the latest ceiling limitation is the limit loan amount you might incorporate to possess. Inside the 2022, the roof to have a-one-unit property is $970,800.

Pro Idea

The process of obtaining an enthusiastic FHA financing is fairly equivalent on method you make an application for other kinds of mortgage loans.

- Find a keen FHA-accepted financial. Fortunately that most financial institutions, borrowing from the bank unions, an internet-based lenders render FHA money, and this really should not be nuclear physics. Since home loan terms and conditions can vary considerably with regards to the financial, be sure to get in touch with numerous FHA mortgage brokers and request good quote from each of them.

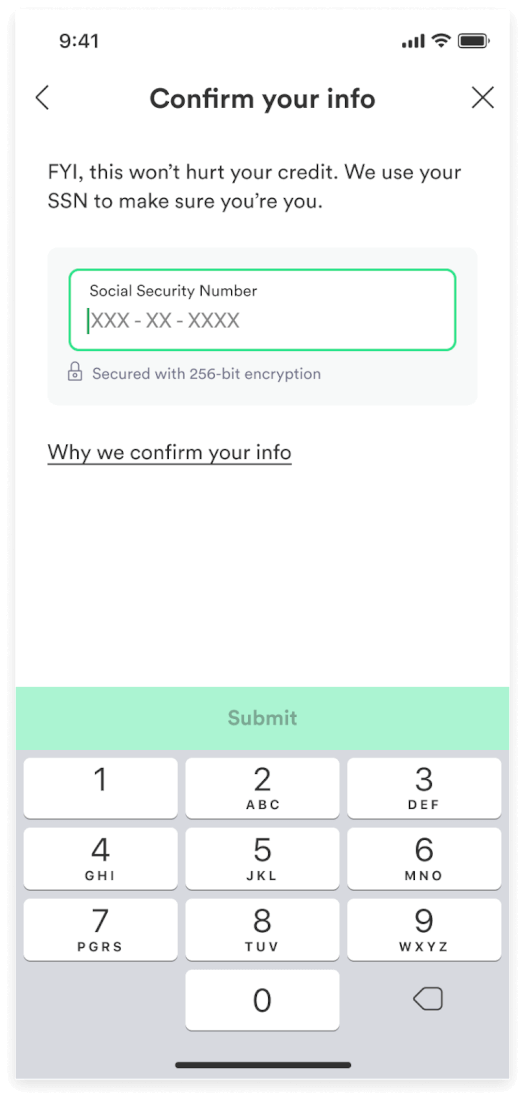

- Start your financial app. Doing the application, lenders usually generally speaking require some extremely important details about your bank account. This might require that you give records proving you’ve got adequate, secure, and you can alternative income. These records include your latest pay stubs, W-dos forms, money money, financial statements, etc.

- Evaluate loan quotes. After you might be through with the application, you really need to up coming found financing imagine regarding mortgage lender. Mortgage prices bring important info regarding the month-to-month mortgage repayments, the estimated rate of interest, and also the full settlement costs toward financing. Make sure you compare mortgage rates regarding various loan providers prior to making the past choice.

Settlement costs

The latest closing costs of your own FHA financing are like those from a traditional financing. You really need to anticipate paying as much as dos% in order to six% of your own overall loan amount.

Eg, in case the property you plan purchasing will cost you $five hundred,one hundred thousand, you’ll have to shell out from $10,100 to help you $31,100 in closing will set you back. So make sure you keep this in mind before purchasing an effective foreclosed house with an FHA loan.

If you are looking having a casing solution that wont crack the lender, a great foreclosed family could be a alternative. Yet not, be prepared for specific really serious legwork.

As the an excellent foreclosed residence is reclaimed by the lender or regulators bank, each one of these qualities need significant solutions. To have household flippers, that isn’t an issue, but the fresh home owners may prefer to stay away.

In which is it possible you select foreclosure for sale?

If you are searching to track down a beneficial foreclosed home, you can search to possess higher excellent deals for the a residential property record internet sites particularly Zillow.

You can also find property foreclosure to the HUD Household Shop. The fresh home here are features that happen to be obtained by government entities due to foreclosures towards an enthusiastic FHA financial. You can even read the Freddie Mac’s HomeSteps and you can Fannie Mae’s HomePath for further postings.