Homeownership are an aspiration for many, and you can efficiently paying a home loan was a great milestone worth remembering. not, your way doesn’t end towards the last installment of your own mortgage. Discover a critical step you to definitely remains: getting your own Zero Objection Certificate (NOC) labeled as Financing Closure Page. It document is very important about transition off a borrower to a sole homeowner. Less than, i look into new the inner workings of your own NOC, its benefits, in addition to actions in protecting they.

The initial step is making certain the expenses is eliminated. For example the fresh new percentage of one’s latest EMI and you will any relevant charge otherwise costs. Prove to the bank your loan account reflects a zero balance and ask for an account closing statement.

1. Making sure Precision from the NOC

Once you have the NOC, you should examine everything meticulously. For example your label, property details, loan membership count, or any other related pointers. People error regarding NOC can lead to problem regarding the coming.

2. Updating Government Details

Towards NOC at your fingertips, the next action is to obtain the home info updated. This involves visiting the local civil expert or even the house details office to remove this new bank’s lien in the possessions title Calvert loans.

step 3. Safekeeping of your NOC

Shop the NOC inside the a secure put. It is a crucial file for all the upcoming purchases within property. Dropping it will produce unnecessary courtroom headaches.

cuatro. Consulting a legal Coach

If you find yourself being unsure of in the any step up the procedure or the fresh new judge ramifications of your NOC, it’s advisable to talk a legal mentor. They’re able to give pointers and make certain that actions are observed truthfully.

Preferred Pitfalls to eliminate

- Decelerate for the Trying to get NOC: Do not procrastinate to the obtaining the NOC just after cleaning your loan. As soon as loan try paid back, begin the process to obtain the NOC.

- Not Evaluating the fresh NOC: Guarantee that all the details throughout the NOC is actually direct. Discrepancies on document can lead to legalities later.

- Maybe not Updating Regulators Suggestions: Maybe not updating government info on the NOC can create challenge in upcoming purchases. It’s imperative to done this task to make certain clear control.

Paying your residence loan is a success, but your obligations doesn’t prevent there. Having the NOC is a serious step-in totally creating the control and you may making certain that you deal with no court obstacles regarding coming. Following these pointers, you could potentially be sure a softer change into the being the unencumbered proprietor of your property.

Faqs In the NOC for Financial

Sure, getting a no Objection Certificate (NOC) is essential following the closing regarding a loan. The fresh new NOC try an appropriate document approved from the lender (financial otherwise financial institution) confirming the loan could have been totally paid down and that they haven’t any claim across the assets. It’s crucial for clearing the brand new term of your home and you can exhibiting that there exists no a fantastic fees of this it.

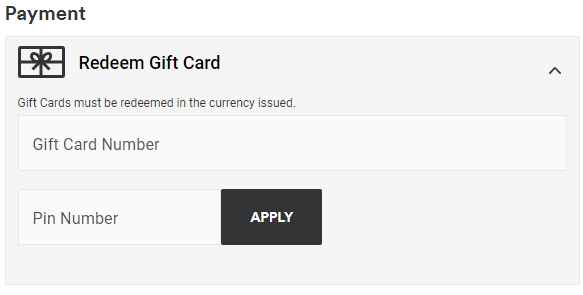

Consult a NOC from your lender. This may constantly be performed because of the customer service company otherwise in the branch where you took the loan.

Of a lot lenders now bring on the internet organization for acquiring a keen NOC. You’ll generally speaking need sign in your bank account toward lender’s webpages and implement toward NOC beneath the loan administration area. However, the availability of this particular service may vary with respect to the financial.

Essentially, a good NOC getting home financing does not have an expiration time. Immediately after given, it stays valid forever as it is a declaration the financing might have been fully paid while the financial has no claim toward possessions.

As stated, the newest NOC having a home loan usually doesn’t always have a great authenticity period. Its a long-term file you to certifies this new closing of the mortgage.

Facts in future Purchases: Offering the property or applying for a special financing against it will end up being challenging in the place of a keen NOC as the evidence of loan closure.