When you are currently on the disability, it’s important to be aware that you may qualify for an individual financing. How simple it might be relies on the kind of impairment you might be choosing as well as the sort of financing you’re looking for. Read on for additional info on landing financing while on handicap as well as how it might effect your own monthly professionals.

Is it possible you score a loan while on handicap?

You can buy a loan while on handicap for individuals who meet the requirements. Regular criteria were the absolute minimum credit rating and you can a max count of present debt (so it may vary predicated on your income). Just how long it will require to acquire a loan may differ, nevertheless shouldn’t bring lots of weeks for many financing

Just how do a loan apply to impairment pros?

Financing you certainly will alter your Supplemental Protection Earnings (SSI) qualifications. Depending on the Social Shelter Management, that loan is not believed income. But not, for many who borrow money and do not purchase they an identical times, it does amount towards the your own financing maximum. Whether your info surpass allowable limits, you will not found SSI benefits for this day.

So if you get SSI, do not apply for your loan one which just want it and you may imagine applying at the end of brand new day.

Types of handicap fund

If you plan locate financing during disability, the sort of financing you have made will depend on the reason why you want to buy. Here are some choice.

Unsecured loan

A personal loan can be used for some explanations, along with to finance medical expenditures or an engagement ring. Each one of these financing don’t need collateral.

You will have to establish you might pay for new mortgage towards the top of people existing financial obligation. This really is a barrier for all those towards the disability, since you are researching an extremely more compact earnings. Generally there actually far space for brand new debt money. To have let searching for such constraints, review the maximum you might use having a personal loan. You can also consult among consumer loan loan providers for the all of our listing.

Real estate loan

You are able to utilize the enough time-name or permanent impairment earnings to qualify for a home loan. Some home loan applications will additionally leave you special advantages in the event that youre handicapped. Such, if you find yourself a disabled veteran, you could apply for a waiver of one’s Va financing resource payment.

Or if perhaps your income is reduced, the fresh new USDA gets the Single Members of the family Construction Head Financing program, where in fact the regulators pays a fraction of the homeloan payment. You can find out a great deal more in our guide to USDA financing.

Whenever you are to the short-title handicap, you could just depend on those individuals costs getting a restricted count of energy. Since your handicap money commonly stop, your home loan software is denied when you have not any other sources of earnings. However, while however functioning and certainly will document that you have work to go back to help you after your handicap gurus end, the loan financial may think about your regular income also your own handicap income.

Handicap financing

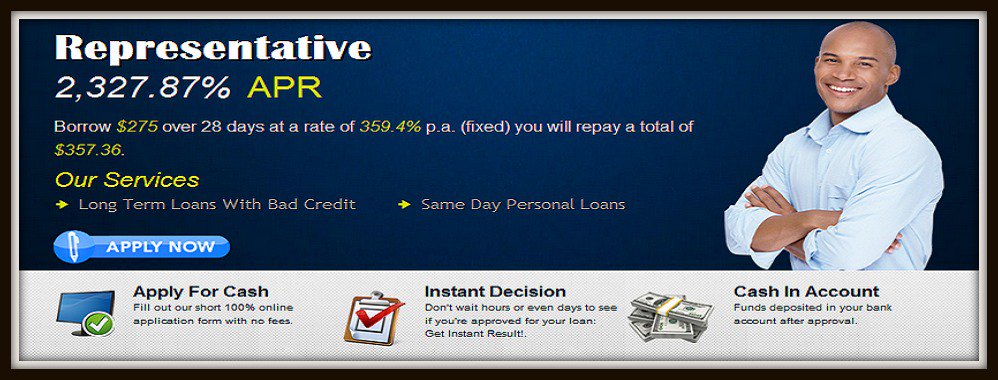

People pick that loan to bridge the new pit anywhere between to-be handicapped and the time they start to receive disability money. This can be a personal bank loan, and you https://paydayloansconnecticut.com/oakville/ should approach it with caution. These loan is expensive and get a primary fees months. In the event your handicap allege requires longer than your requested, you exposure defaulting to the loan. Including, when your impairment claim is actually refuted, you are nevertheless towards connect to the loan.

Before you take an initial-term loan to own envisioned disability, find out if you are eligible for disaster handicap guidance. SSI readers could possibly get expedited SSI benefits lower than certain issues. More resources for your options, it is better in order to connect with your jobless office.