So many Us citizens have a problem with obligations. A survey held from the Hometap in the 2019 off nearly 700 U.S. homeowners revealed that even though many people is actually household-rich, they’re also bucks-worst, with little big date-to-go out liquidity. Survey takers shown whenever they did have personal debt-free entry to their residence’s collateral, such as for instance a home guarantee advance, that they had use it to settle personal credit card debt, medical debts, or even let family and friends pay back personal debt.

Of a lot residents responded that they haven’t actually considered solutions to help you tap into their property equity. In a nutshell, they think stuck since offered monetary choices simply frequently add a great deal more personal debt and you may focus on the homeowner’s month-to-month equilibrium sheet sets. There is also the issue of qualification and you may acceptance, because it’s hard to meet the requirements of a lot financial support alternatives, for example a property collateral loan, with less than perfect credit.

The good thing? It domestic steeped, bucks bad condition quo doesn’t have to carry on. Here, become familiar with regarding requirement for borrowing, and how you could still accessibility your house collateral in the event the your very own are very poor.

What’s Credit and exactly why Will it Amount in order to Lenders?

Credit is the power to so you can borrow funds, see activities, or fool around with attributes if you are agreeing to provide percentage from the an after go out. The phrase credit rating describes good around three-little finger number one to suggests the amount of honesty you presented inside for the past through expertise in loan providers, loan providers – basically, any business that has considering you currency. This information is achieved for the a credit report thanks to a choice of various source, such as the amount of playing cards you have got, as well as people a good balance on them, your own reputation for financing and cost decisions, timeliness off payment fee, and you will tall trouble such as for instance bankruptcies and you will foreclosures.

To phrase it differently, loan providers want to be just like the sure you could which you are able to spend right back hardly any money they give for you, and checking the credit is a simple and you may apparently comprehensive approach to collect this article.

If you are holding a number of loans consequently they are concerned with their credit, you may think your home equity try unreachable. However with a different sort of, non-obligations resource option offered to a number of people, you will be astonished at what you could availableness. Here are some ways you can utilize your home guarantee to begin with having fun with one to liquidity to-arrive debt desires. ?

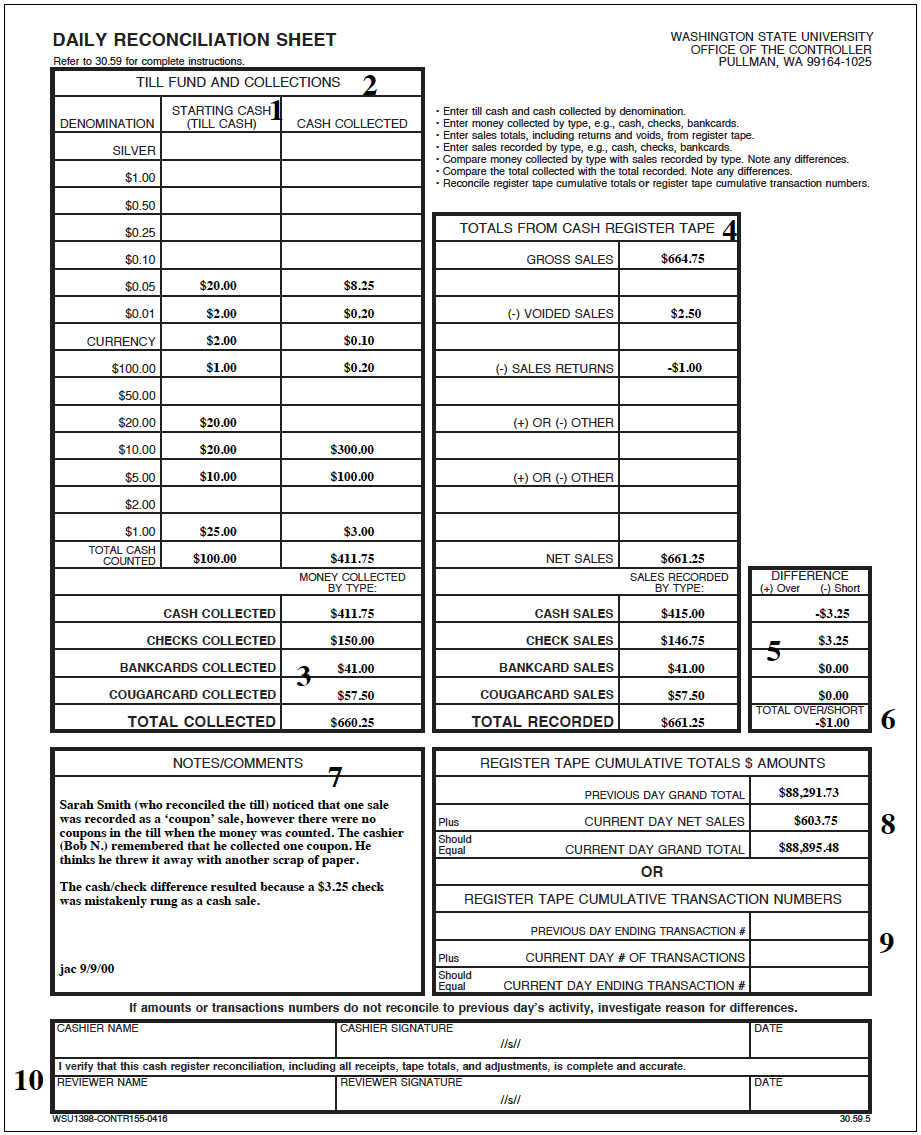

Comprehend the chart below getting an instant report about the choices that would be out there predicated on your credit rating, following keep reading for more in the-breadth meanings of any.

Cash-Away Refinance

A funds-aside re-finance happens when your, the newest homeowner, take-out a new, larger home loan, repay your mortgage, and make use of the extra to fund your needs. You can do this throughout your existing bank otherwise a different financial in fact it is perhaps not believed an additional mortgage. Predicated on Bankrate , you generally speaking you prefer at least 20% equity on your assets loan in Atmautluak AK to qualify, and you will probably spend notice to the lifetime of the mortgage (constantly 15 or 3 decades). From the much time duration of a money-away refi (while the they’re commonly known), you will need to guarantee the interest as well as your requested payment package go with their month-to-month finances. Homeowners are typically expected to provides a credit history minimum of 620 become accepted having a funds-aside re-finance.

Domestic Security Mortgage otherwise House Equity Personal line of credit

Might you be eligible for a property guarantee loan or a house guarantee credit line (HELOC) having less than perfect credit? Earliest, you must know the essential difference between both of these household guarantee alternatives.

A home guarantee loan enables you to borrow funds by using the collateral in your home once the equity. A beneficial HELOC, at the same time, works a lot more like a credit card, in the sense that you could mark cash on a concerning-called for base. With one another home collateral funds and HELOCs, your credit score and you can house security worthy of will play an associate in the way much you can obtain and your focus rate.

The minimum credit rating you’ll need for a home equity mortgage and you may good HELOC are at the least 620, although it depends on the financial institution. However, even if you try not to meet which lowest credit history getting property security mortgage or HELOC, avoid being annoyed. Julia Ingall having Investopedia claims home owners that have bad credit is testing buy lenders offered to handling consumers for example him or her. While doing so, Ingall cards one to working with a large financial company can help you take a look at your alternatives and you may support credible lenders.

Household Security Progress

A home collateral advance has the benefit of property owners the capability to tap into the long run value of their house to availability the collateral now. A property security investment is a smart way doing only you to.

During the Hometap, home owners can also be located domestic security financial investments so they are able explore a few of the equity obtained obtained in their home doing other economic wants . Brand new resident gets bucks without having to promote and take out a loan; as there are no interest without payment per month. . Another advantage away from good Hometap Investment would be the fact hundreds of issues is taken into account to help you accept a candidate – credit rating isn’t the identifying requirement.

Offer Your property

For some, it is a last resorts, however, property owners having bad credit can access the residence’s equity by promoting they downright. Needless to say, it choice is actually predicated through to searching for a more affordable household to possess your future house, together with advantageous financial words for your the brand new put, and you may ensuring that you do not invest too much towards the a house charges otherwise swinging will cost you. you could probably improve your credit history in advance of you’re able to this time. Keeping track of your credit rating to store a close look aside to possess possible issues and you can inaccuracies, maintaining a balance better below your borrowing limit, and you will keeping dated membership open are a beneficial towns and cities first off.

While impact domestic-rich and money-poor for example so many People in the us , you’ve got many choices to access your property guarantee. Just like any big capital choice, speak with a reliable economic top-notch to determine your very best way of action, and have moving to your your aims.

We do the best to make certain that all the information during the this post is because the exact as you are able to since the fresh date its published, but some thing changes easily often. Hometap will not endorse or screen any linked websites. Private products differ, thus check with your own money, tax or lawyer to determine what is sensible to you.