These costs include raw materials, labor, and any other direct expenses that are incurred in the production process. But under absorption costing sales and production (production creates inventory) both influence profit of a period. Profit in variable costing is not affected by changes in inventory as it is in absorption costing. The budgeted output was 150,000 units and the fixed costs of $300,000 are based on this budgeted output. But we can see that the manufactured units are 170,000, which means that 20,000 extra units have been produced. These extra units include the element of fixed cost because our absorption rate has both variable and fixed costs in it.

Income Statement Under Absorption Costing? (All You Need to Know)

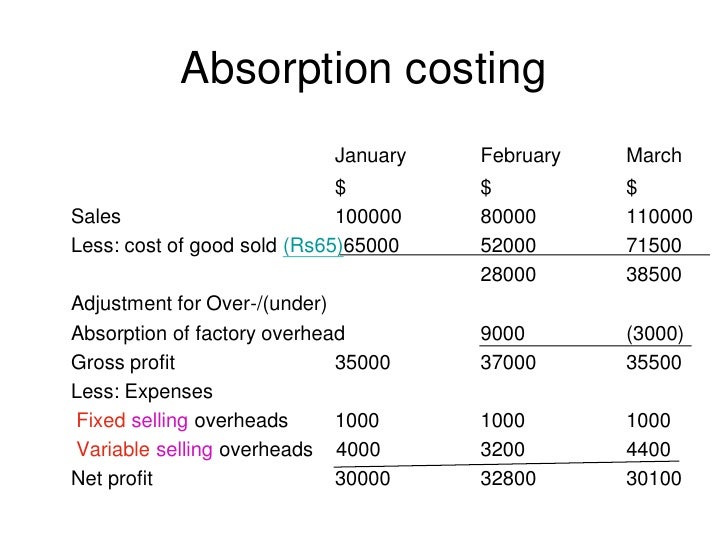

It shows that the gross profit is less than the selling and that the administrative expenses are equal to the operating income. Since COGS is higher under absorption costing, net income is lower compared to variable costing. But absorption costing net income is viewed as more accurate since it allocates all production costs. This differs from variable costing, which only allocates variable costs to units and treats fixed costs as period expenses. The traditional income statement, also known as the absorption costing income statement, is created using absorption costing. It is important to understand the behavior of the different types of expenses as production or sales volume increases.

if (t.invoked) return void (window.console && console.error && console.error(“Drift snippet included twice.”));

Fixed overhead costs can be calculated per unit because they change per unit and not in total. Absorption costing allocates all manufacturing costs, including fixed overhead costs, to the units produced. Absorption costing is a GAAP-compliant method of accounting for all manufacturing costs as product costs, including both variable costs and fixed overhead costs. This leads to an accurate representation of product cost on the income statement.

Absorption Costing Explained, With Pros and Cons and Example

Absorption costing means that every product has a fixed overhead cost within a particular period, whether sold or not. This means that every cost must be included at the end of an inventory and is usually done as an asset on the balance sheet. As a result, it is not unusual to find out that there is a lower expense on the income statement when using an absorption statement. This causes net income to fluctuate between periods under absorption costing.

Overhead Absorption Rate Formula

Since this method is widely used by many manufacturing companies, it is necessary yo know the advantages and disadvantages of the same. We’re a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%. The amount of under-absorption is added to the cost of items created and sold if the actual output level is less than the normal output level.

- Absorption costing is a GAAP-compliant method of accounting for all manufacturing costs as product costs, including both variable costs and fixed overhead costs.

- Once you have the unit cost, the rest of the statement if fairly straight forward.

- Absorption costing is by GAAP because the product cost includes fixed overhead.

- As companies build up their inventory, a portion of the fixed costs is capitalized on the balance sheet rather than expensed on the income statement.

- The absorption rate is usually calculating in of overhead cost per labor hour or machine hour.

- Absorption costing is an accounting method that captures all of the costs involved in manufacturing a product when valuing inventory.

Variable expenses are subtracted from gross sales to arrive at contribution margin before finding net income. Marginal income statements make it easier for managers to understand product margins and production efficiency. However, absorption-style income statements are required by generally accepted accounting principles. Variable costs are explicitly labeled on a variable costing income statement. Under sales revenue, there should be a line item labeled “Cost of Goods Sold” and “Variable Selling, General and Administrative Expenses”. Absorption costing is an easy and simple way of dealing with fixed overhead production costs.

The application of absorption costing extends across various sectors, each with its unique characteristics and cost structures. The method’s adaptability allows it to be tailored to the specific needs of different industries, from manufacturing to services and retail. The following subsections delve into how absorption costing is utilized within these diverse business environments. This Bulletin summarizes the ASU, including the new disclosure requirements and effective dates. This ASU does not change income statement presentation requirements but instead expands the disclosure requirements for specific costs and expenses.

Kristin is also the creator of Accounting In Focus, a website for students taking accounting courses. Since 2014, she has helped over one million students succeed in their accounting classes. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. The Absorption costing aims to recover Fixed Costs and some Returns on Investments. Discover the top 5 best practices for successful accounting talent offshoring.

Absorption costing provides a more accurate, GAAP-compliant method of accounting for all production costs. By including fixed overhead costs in product costs, it presents a fuller, incremental view of profitability. The main advantage of absorption costing is that it complies with generally accepted accounting principles (GAAP), which are required by the Internal Revenue Service (IRS). Furthermore, it takes into account all of the costs of production (including fixed costs), not just the direct costs, and more accurately tracks profit during an accounting period. Under generally accepted accounting principles (GAAP), absorption costing is required for external reporting.

Both Absorptions costing and variable cost have a relationship with fixed overhead costs. However, while absorption costs shared fixed overhead costs into various units produced within a particular period, variable costing sums them all together. Variable costing also reports all expenses made with a period as who can i claim as a dependant on my tax return a single item different from the cost of goods sold or still available for sale. So in summary, absorption costing income statements allocate all manufacturing costs (variable and fixed) to inventory produced. This results in fixed costs impacting COGS rather than flowing straight to the income statement.

Absorption costing is a tool used in management accounting to capture entire expenses connected to manufacturing a certain product. For external reporting, generally recognized accounting principles (GAAP) demand absorption costing. Therefore, you should treat the selling and administrative costs like a mixed cost.