Ans: Getting a personal loan out of your company to find property can notably impression your financial considered and income tax condition. This arrangement concerns month-to-month EMI write-offs out of your salary, which brings up questions relating to taxation implications. Why don’t we speak about this adequately.

Skills Boss-Disbursed Personal loans Workplace-disbursed personal loans are beneficial as they often feature lower rates and convenient payment conditions.

Tax Implications on the Boss Funds In case the boss disburses an excellent financing, it is far from quickly felt part of their taxable money. Yet not, particular issues can determine just how it is taxed.

Perquisite Worth Calculation New perquisite well worth is the difference in the latest business interest and concessional price toward loan amount

Exemption Limitations Funds to possess construction up to Rs 20 lakh normally have particular tax exemptions. Whether your loan amount exceeds Rs 20 lakh, the whole number could possibly get attract some other income tax solutions.

Month-to-month EMI Deductions and you can Tax Monthly EMI deductions dont privately decrease your nonexempt earnings. Yet not, the attention element of your EMIs can have taxation ramifications.

Attract into Financing The attention part of their EMI is stated since the good deduction lower than Part 24(b) of your Tax Operate, up to Rs 2 lakh per year for a personal-occupied house. That it reduces your nonexempt earnings.

Prominent Installment The principal percentage of your own EMI will be reported lower than Part 80C, subject to the general restrict off Rs step 1.5 lakh. This facilitates cutting your taxable income.

If for example the financing is provided within a good concessional rate of interest, the essential difference between the business speed as well as the concessional rate are believed an excellent perquisite

Analogy Calculation Let’s break so it off that have an illustration and come up with it sharper. Guess your yearly paycheck try Rs 10 lakh, therefore need a good Rs 20 lakh financing at a good concessional price regarding 4%, as industry rate was 10%.

Perquisite Really worth = (ount Perquisite Worth = (10% – 4%) * Rs 20 lakh Perquisite Value = 6% * Rs 20 lakh = Rs step one.dos lakh This Rs step 1.dos lakh is set in your taxable income.

Attention Deduction Assume the attention paid-in a-year try Rs 80,000. You could potentially allege doing Rs 2 lakh under Part 24(b), hence lowering your nonexempt income.

Prominent Deduction Suppose the principal paid down from inside the a-year is actually Rs 1.dos lakh. You could allege it lower than Part 80C, up to the restrict out-of Rs step one.5 lakh.

Less: Section 24(b) Deduction = Rs 80,000 Smaller: Part 80C Deduction = Rs step 1.2 lakh Net Taxable Earnings = Rs eleven like this.2 lakh – Rs 80,000 – Rs 1.2 lakh = Rs 9.2 lakh

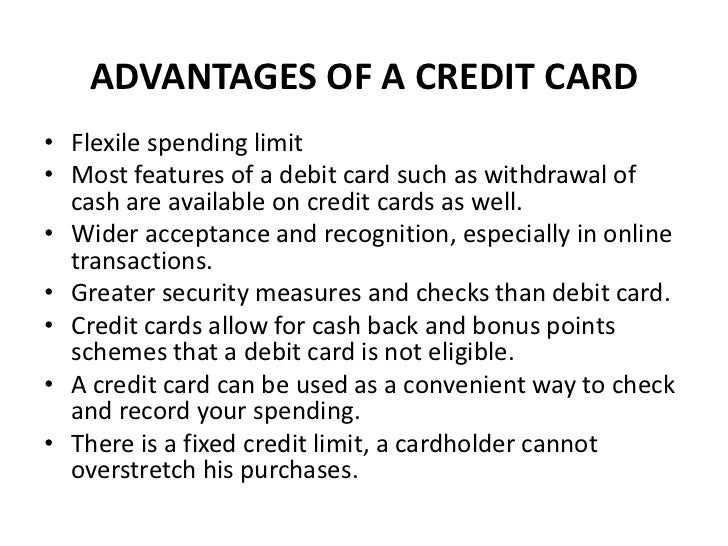

Great things about Company-Paid Financing Boss-disbursed fund shall be beneficial because of straight down interest rates and you will simplistic running. The primary positives are:

Financial Thought which have Workplace Loans Proper Use of Write-offs Increase your own income tax masters because of the utilising Section 24(b) and you may Point 80C deductions. Bundle your money to ensure you fully apply this type of parts.

Cost management to possess EMIs Make sure your month-to-month finances caters the fresh EMI write-offs conveniently. This will help within the maintaining economic balance instead of limiting into almost every other expenses.

Crisis Financing Manage a crisis funds to cope with one financial contingencies. That it implies that debt plan remains on course even with unexpected costs.

Top-notch Pointers Official Monetary Coordinator (CFP) Contacting a certified Monetary Planner also provide designed advice on managing the loan and tax implications. A CFP might help optimize the tax professionals and you can financial support actions.

Normal Financial Ratings Carry out normal monetary product reviews to evaluate the new impact of mortgage on the total financial health. It implies that your stick to track with your monetary requires.

Latest Information Boss-disbursed personal loans to possess house buy incorporate several benefits and you can tax ramifications. By the knowledge these types of issues, you could make informed decisions and you will optimize debt planning.

The patient method to dealing with your bank account is commendable. That have strategic think and professional suggestions, you could potentially efficiently take control of your loan and increase taxation gurus.